From the front porch of his 19th century home on the quiet, tree-lined 1300 block of East Wilson Street, Dan Wehrman often can hear the comments of bicyclists pedaling past.

"People come off the east side bike path and say things like, 'God, I just love this street,' " says Wehrman, 61, a homeowner there since 1992.

So do most residents.

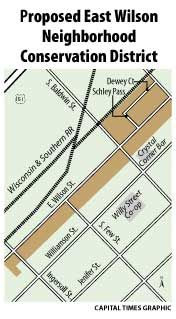

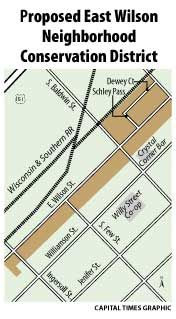

A block off bustling Williamson Street and just around the corner from the iconic Crystal Corner Bar, the East Wilson/Schley Pass/Dewey Court area is unique.

The neighborhood features small, 1½-story bungalows with front porches, many dating to the 1800s. A variety of gardens, whether tended or not, provides a leafy green feel.

An eclectic mix of owner-occupants, renters, families and singles makes it arguably one of the most diverse and affordable neighborhoods in the central city. Homes there can still be had for $150,000, although they might need some fixing up.

And now, a group of dedicated east-siders is pushing for their turf to become the city's first Neighborhood Conservation District (NCD), which would give it permanent legal protection.

Passed in 2007, the Neighborhood Conservation District ordinance is designed to safeguard the character and architectural style of neighborhoods that might not otherwise qualify for historic preservation. One goal is to prevent real estate speculators from coming into an area, acquiring several adjoining properties and then tearing them down to build something bigger.

But NCDs also give homeowners the flexibility to improve their own property while making sure any changes respect what's already there.

"Obviously this neighborhood never housed the movers and shakers of the city," says Leslie Schroeder, who with her husband, Nick, has restored an older home within the proposed district. "But there is value in its character, and there is a story worth honoring, too."

That story includes immigrants who settled in Madison following the Civil War and built homes in what was once the industrial heart of the city. The Atlas hotel at 221 S. Baldwin St. -- now the Port St. Vincent men's shelter -- formerly served weary workers from the Milwaukee Road railroad.

Last week, the Madison Plan Commission voted to study establishing a conservation district for the East Wilson area. City planning department staff will begin a process that could come before the full City Council within the next year.

"It's nice to see one of these finally moving forward," says east side Ald. Marsha Rummel.

But not everyone is jumping on board. A survey mailed to area residents, owners and businesses last year showed some are skeptical, fearing another layer of zoning.

Among them is Philip Simeon, a native of the Caribbean, who with his family lives across the street from Wehrman. While Simeon doesn't want to see a large condo project go in, he's worried an NCD could make it harder to work on his place, whether he's trimming trees or finishing off the attic space.

"America is a place of diversity, whether it's language or the kinds of houses people want to live in," he says.

Schroeder counters that the pending study and upcoming meetings will give all stakeholders a chance to craft the district to their liking.

"The great thing about conservation districts is that each neighborhood can work it out themselves" says Schroeder, whose home at 213 S. Baldwin St. was honored in 2003 by the Madison Trust for Historic Preservation.

Far east side Ald. Michael Schumacher has some doubts about the process, too. He noted during a Plan Commission discussion of the issue that less than 20 percent of some 240 city mailings about the East Wilson NCD were returned completed; of those, only 18 of 41 respondents were in full support.

"It looks to me like we are down to just 18 people wanting this," he said.

City planner Michael Waidelich said he was somewhat surprised at the lack of survey responses but admitted the effort was a work in progress. "We've never done one of these before, so we're not exactly sure what the final parameters will be," he said.

The idea of NCDs in Madison dates to the late 1990s. Plans floated at the time called for three Neighborhood Conservation Districts: the Bassett area west of the Capitol, and the First Settlement and Old Market areas east of the Capitol.

"At the time, the real estate market was booming, and there was a great deal of concern for existing neighborhoods," says Ald. Rummel, whose District 6 predecessor, Judy Olson, was an early backer of NCDs.

But the preservation ordinance, which faced strong initial opposition from development interests, didn't make it on the books until two years ago. It requires that a majority of property owners on eight contiguous block faces agree to be included the district.

Wehrman's own interest was piqued two years ago when his next-door neighbor did a complete rebuild of an older property, going taller than any other home on the block.

"I just felt like something had popped -- that people were starting to flip houses over here," says Wehrman, a former Navy man who now works as a self-employed safecracker.

Wehrman continues to make upgrades to his own home. He's added solar water heating panels to the back roof, refinished the wide-plank pine floors and returned the front porch to its original open format.

And while the real estate boom has cooled, Wehrman wants to make sure areas like East Wilson can remain intact. He notes there is computer technology available today to help guide residents, developers and the city on what new projects might look like before they are actually completed.

"I honestly believe there is strong neighborhood support for this," he says.

(Article by Mike Ivey, The Capital Times)

Tin Can Alley

Tin Can Alley

"At the time, the real estate market was booming, and there was a great deal of concern for existing neighborhoods," says Ald. Rummel, whose District 6 predecessor, Judy Olson, was an early backer of NCDs.

"At the time, the real estate market was booming, and there was a great deal of concern for existing neighborhoods," says Ald. Rummel, whose District 6 predecessor, Judy Olson, was an early backer of NCDs.